The history of the Strattner family is one of resilience, cultural patronage, and an enduring commitment to progress. Their journey, spanning centuries, reflects a harmonious blend of artistry, innovation, and diplomacy. From their early contributions to European culture to their later influence in finance, the Strattner family’s story is one of inspiration and vision.

Christoph Strattner († 1625 in Frankenburg) was a market judge (Marktrichter) and innkeeper in Frankenburg am Hausruck, Austria. As a respected figure in his community, Strattner played a key role in organizing local life and mediating disputes. However, his life took a dramatic turn during the tumultuous period of the Counter-Reformation.

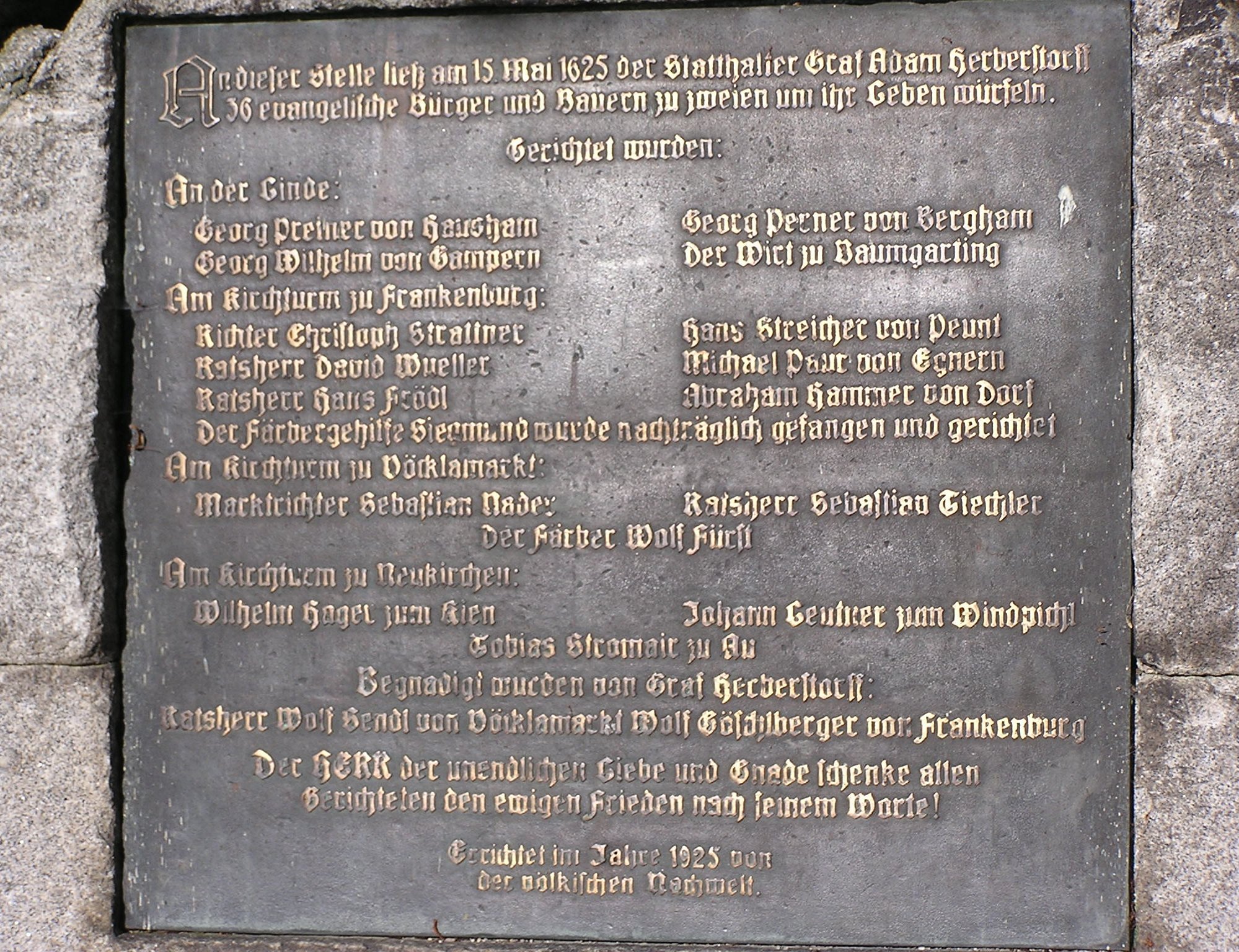

In May 1625, Christoph became embroiled in a rebellion against the Catholic Bavarian authorities, led by Adam Graf von Herberstorff, who sought to suppress Protestantism in the region. For his participation in the uprising, Christoph was hanged, becoming a symbol of defiance and the enduring fight for justice. His story lives on in the Frankenburger Würfelspiel, a theatrical reenactment first performed in 1925, which portrays the events of the rebellion.

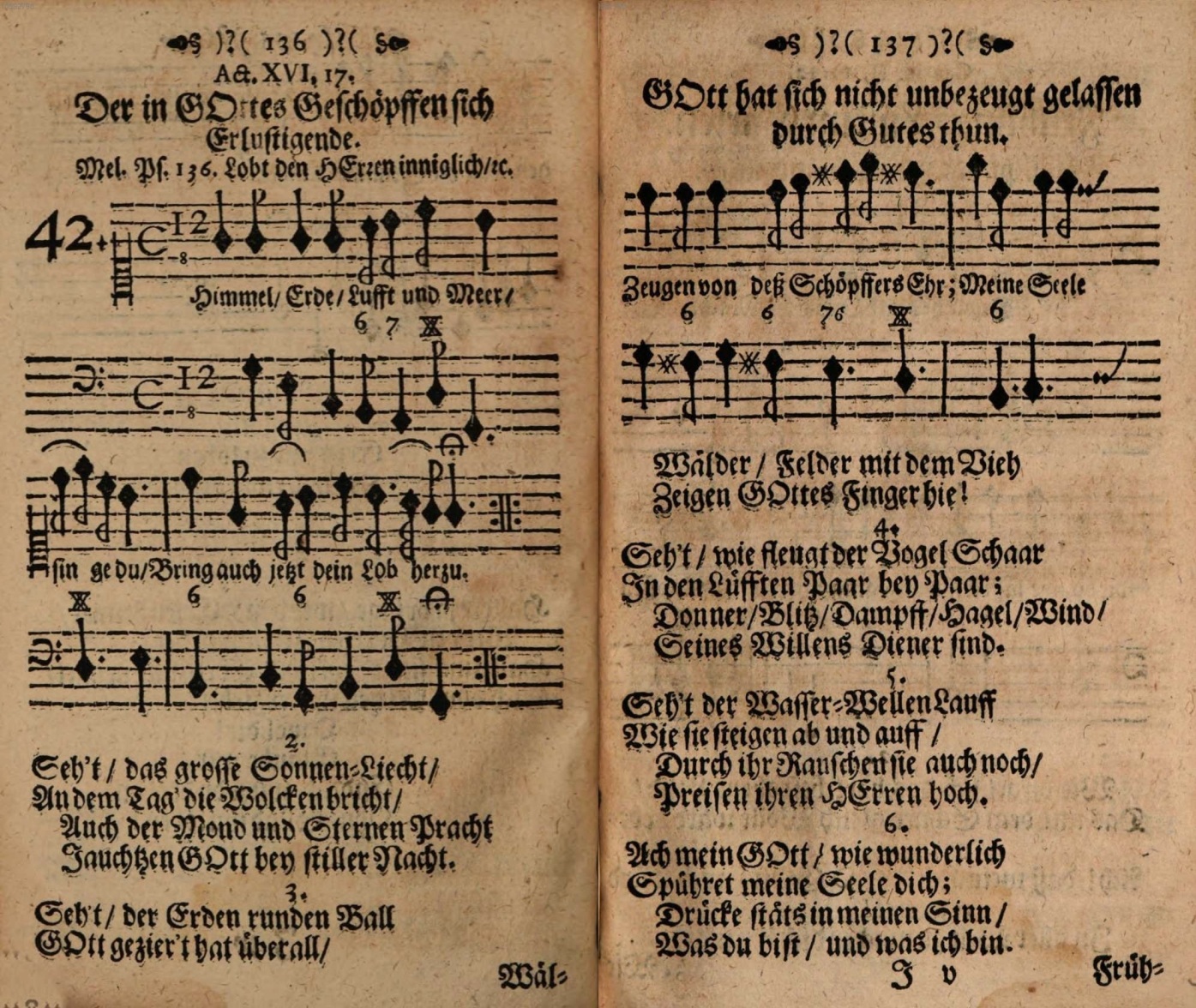

Georg Christoph Strattner was a notable German church musician, composer, and hymn writer of the Baroque era. Born around 1645 in Gols, then part of the Hungarian Burgenland (now Austria), he received his initial musical training from his cousin, Samuel Capricornus, the music director at the Dreifaltigkeitskirche in Preßburg. At the age of fourteen, Strattner became a choirboy at the Stuttgart court chapel, marking the beginning of his musical career.

In 1694, he secured a position at the court chapel in Weimar and was promoted to vice capellmeister (Particulier Kammermusikus und Vice-Capellmeister) in 1695, succeeding August Kühnel, with Samuel Drese serving as capellmeister. Strattner composed several cantatas, of which about twenty survive in manuscript form, and numerous hymns characterized by melodies reminiscent of arias. He passed away in Weimar, where he was buried on April 11, 1704.

Building on Georg Christoph’s success, later generations of the Strattner family entered farming and trade potentially leveraging their cultural connections to gain prominence in European markets. By the 18th century, the family had established themselves as trusted advisors to noble households. Their contributions to infrastructure projects and regional economic stability earned them recognition from ruling authorities.

Maria Strattner, grand mother of Pierre Charles Melaine de Philbert, Baron of Bidestroff, died in the Bidestroff Castle on April 16, 1723.

In 1765, further nobility was granted the family in recognition of their service to the Slesian Empire’s economic and cultural development. This marked the Strattners’ formal entry into the ranks of nobility, cementing their reputation as stewards of progress.

The Strattner family, over generations, acquired these noble titles through strategic alliances, service to rulers, economic and legal events.

The title of Duke of Wolów, rooted in Silesia’s rich and complex history of shifting allegiances between the Polish and German crowns, is deeply intertwined with the region’s historical narrative. This area, renowned for its strategic significance, became a focal point during pivotal moments of the Great Turkish War, where remarkable leadership and steadfast commitment safeguarded territories of immense geopolitical importance.

The historical titles of Ban and Voivode reflect a legacy of governance and military prowess. As Bans, the stewardship over Croatian territories fostered economic stability and upheld the rule of law, leaving an enduring mark on regional development. In their capacity as Voivodes, exceptional leadership on the battlefield defended domains against external threats, reinforcing their role as protectors of the realm. These titles symbolize historic responsibilities and enduring influence across Europe.

Through strategic alliances, exceptional service, legal and economic events, and an unwavering commitment to their values, the Strattner family earned these illustrious titles. Each title represents a chapter in their journey, weaving a tapestry of leadership, resilience, and influence that culminates in their modern legacy as stewards of progress and innovation.

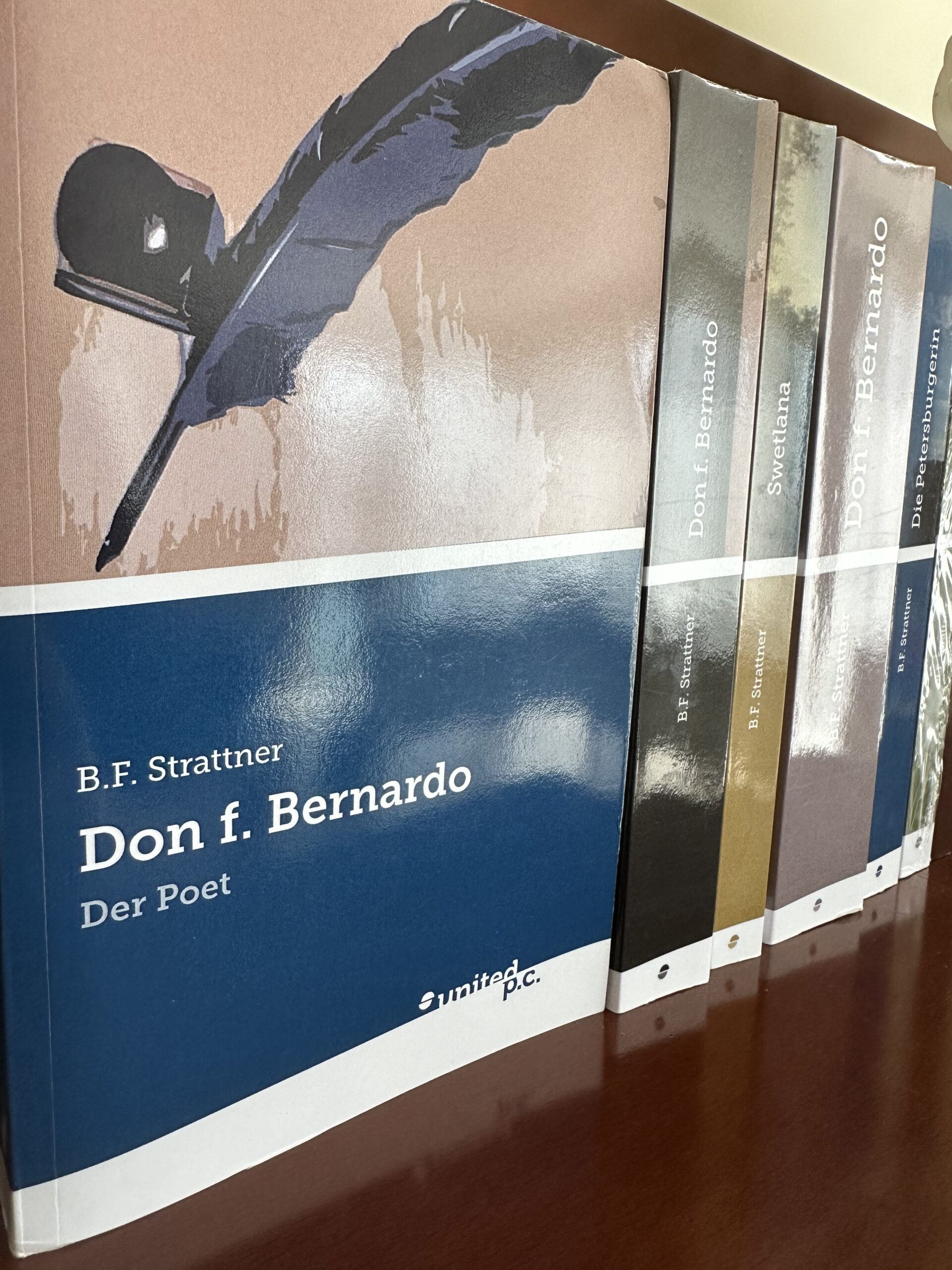

As a result of a successful legal outcome built on historical evidence, Timo Strattner has been officially recognized as the rightful bearer of an array of noble titles and is evidenced in the heralding register. The case established his hereditary entitlement to titles such as Duke of Wohlau, Lord and Marquise de Léveville, Lord and Viscount de Auberoche, Baron de Montclar “Noblesse D’Extraction,” Lord of Montbrun, and Lord and Baron de Bidestroff. Furthermore, the court acknowledged his legal right to the German-Hungarian Count title of Graf von Mattersdorf-Forchtenstein, the Count Palatine (Pfalzgraf) of Ban and Voivode, and the lordships of Guns, Kőszegi, and Međimurje (von Murinsel). The ruling was based on an extensive review of historical records and genealogical evidence, affirming the family’s longstanding contributions to governance, military leadership, and cultural legacy. This landmark decision solidifies Timo Strattner’s rightful claim to these historic titles, reflecting a legacy of nobility and influence officially recognized by law.